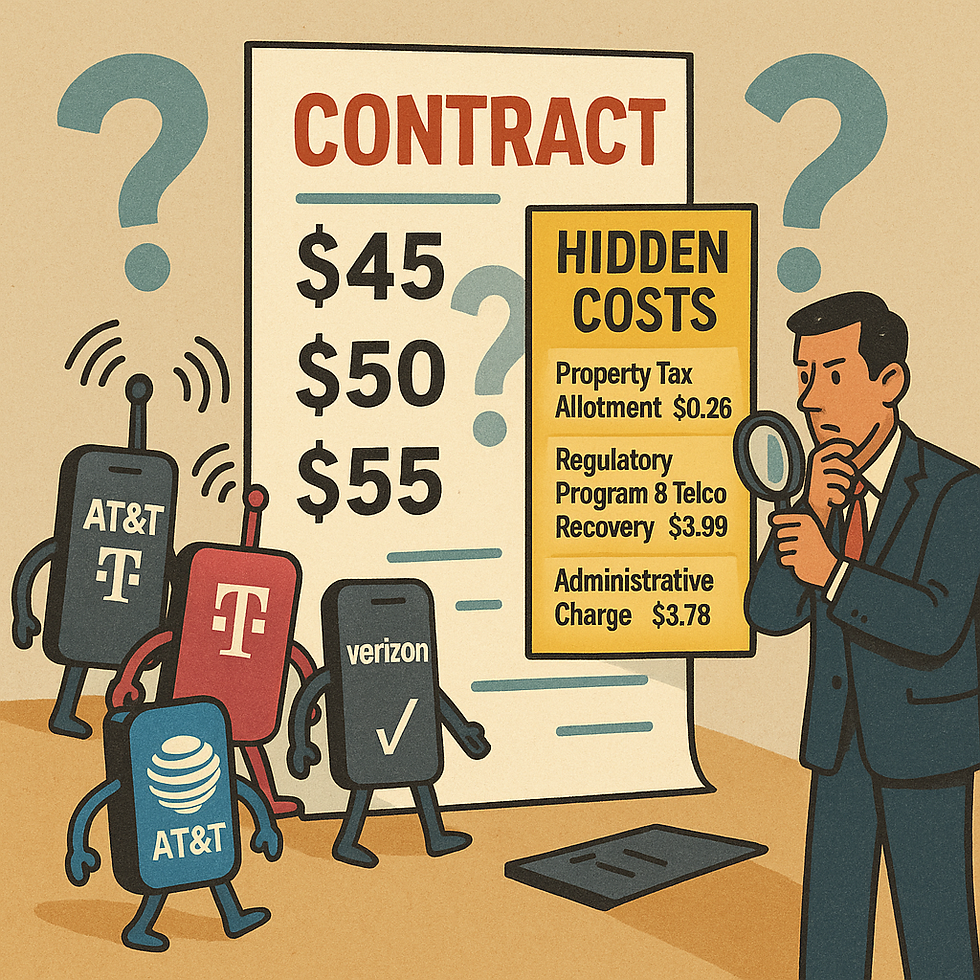

Why Your 'Great' Mobility Contract Is Still Expensive: The Hidden Impact of Surcharges

- Akira Oyama

- Dec 5, 2025

- 4 min read

When enterprises shop wireless contracts, most of the attention goes to one number: the Monthly Recurring Charge (MRC) per line. In the U.S., that usually means comparing offers from the three facilities-based carriers: AT&T Mobility, Verizon Wireless, and T-Mobile.

On paper, one carrier may look clearly cheaper than the others. But when the invoices start coming in, finance asks a painful question:

"If we negotiated such a good rate, why is the bill still so high?"

MRC vs. the real per-line cost

Most sourcing teams line up proposal like this:

Carrier A: $25 per line

Carrier B: $23 per line

Carrier C: $24 per line

Then they pick the lowest number and feel good about the savings.

The problem is that this view usually ignores non-MRC charges that hit every single line, such as:

"Regulatory Cost Recovery"

"Administrative" fees

"Economic Adjustment" charges

"Property Tax" or "Regulatory Program & Telco Recovery" fees

These are carrier-created cost-recovery charges, not government-mandated taxes. Carriers explicitly say in their own fee descriptions that many of these are not government required charges; they're designed to recover the carrier's own operating and compliance costs.

Because they're tucked into the "surcharges and fees" section, they often aren't modeled during contract negotiations - but they absolutely show up in your total cost of ownership.

Examples from real enterprise bills

Here's a simplified illustration using charges I've seen on recent corporate-liable invoices. Exact amounts change over time and by plan, but the pattern is what matters.

ATT Mobility - sample per-line monthly surcharges

Property Tax Allotment: $0.26

Regulatory Cost Recovery: $1.25

That's roughly $1.51 per line per month before you even look at taxes.

T-Mobile - sample per-line monthly surcharge

Regulatory Program & Telco Recovery: $3.99

If this applies to your voice lines, that's $3.99 per line per month in carrier surcharges.

Verizon Wireless - sample per-line monthly surcharges

Administrative Charge: $3.78

Economic Adjustment Charge: $3.97

Regulatory Charge: $0.21

Together, that's about $7.96 per line per month in additional surcharges.

Note: These numbers are examples from specific business invoices. Your fees may differ based on plan, term, and when you're reading this. Always check the current official fee schedules and your own contracts.

Why this matters at scale

On a single line, a couple of dollars may not feel like much. On a large enterprise fleet, it's a different story. Let's take a simple 1,000-line example with the numbers above:

AT&T: about $1.51 x 1,000 lines = $1,510 per month

T-Mobile: about $3.99 x 1,000 lines = $3,990 per month

Verizon: about $7.96 x 1,000 lines = $7,960 per month

Annualized, that's roughly:

AT&T: $18,120 per year

T-Mobile: $47,880 per year

Verizon: $95,520 per year

Those dollars are on top of the MRCs you spent months negotiating.

This is why a contract that looks "2 dollars cheaper" on MRC can still wind up more expensive overall: the surcharges can quietly erase your savings.

How to bring surcharges into your next negotiation

Here's how to turn this into a disciplined process instead of a surprise on the first bill.

Build an "all-in per-line model" model

When you compare carriers, don't stop at MRC per line. Instead, model all-in per-line cost (MRC + carrier surcharges excluding true government taxes).

For each proposal, plug in:

The negotiated MRC

The carrier's current per-line fee schedule from their legal/plan documentation

Any known increases already announced (many fee schedules now state "up to $X" or future effective dates)

Make surcharges explicit in RFPs and contracts

Most RFPs ask:

"What is your monthly rate per line?"

Add questions like:

"List all monthly per-line surcharges that will apply to our corporate-liable lines, with current amounts and caps."

"Confirm whether these surcharges are government-mandated or carrier-imposed."

"What rights do we have in you increase these surcharges during the term?"

The goal is to make surcharges visible and negotiated, not an afterthought.

Push for caps, credits, or "taxes & fees included" options

Depending on your volume and leverage, you may be able to:

Negotiate credits to offset carrier fees

Set caps on specific surcharges or total per-line fees

Move to plans where taxes and fees are included in a single all-in rate (even if the base MRC is nominally higher)

From a finance perspective, a slightly higher MRC with stable, predictable fees can be better than a low MRC that's surrounded by uncapped surcharges.

Partner with someone who actually reads the invoices

This is where a mobility expense management partner adds value:

They read the fine print in carrier fee schedules

They model the total cost of ownership, not just MRC

They monitor fee increases over time and flag when carrier-imposed charges start creeping up.

For enterprise managing thousands of lines, this can be the difference between "We hit our savings target" and "Why did our wireless spend go up after a big RFP?"

Closing thought

When you evaluate mobility contracts, don't stop at the headline rate.

If you're only comparing MRCs, you're effectively negotiating with the top half of the invoice and ignoring the bottom half. The smart move is to compare carriers on the all-in cost per line, MRC plus surcharges, and make those fees part of the negotiation, not a surprise.

You've already done the hard work of getting better rates. Making surcharges visible is how you make sure those savings actually show up on the bill.

Comments